Introduction

The rental landscape in San Bruno is shaped by a dynamic interplay of economic trends, tenant preferences, and competitive pressures. This complexity makes rent pricing strategy a critical focus for property owners. By grasping the intricacies of this strategy, landlords can optimize their lease prices to maximize revenue while attracting quality tenants. Currently, the average rent has surged to approximately $3,272. As the rental market continues to evolve, property owners must consider how to navigate the challenges of setting competitive rates without sacrificing profitability.

Defining Rent Pricing Strategy in Portfolio Management

What is rent pricing strategy in portfolio strategy San Bruno is a structured method that owners and managers employ to set lease prices for their assets. This approach involves a thorough examination of various factors, including economic conditions, real estate valuation, and tenant demographics. The primary objective is to establish a leasing cost that maximizes revenue while understanding what is rent pricing strategy in portfolio strategy San Bruno to remain competitive within the industry.

Effective rent strategies take into account what is rent pricing strategy in portfolio strategy San Bruno, considering operational expenses related to maintenance and the broader economic environment that influences tenant demand. By adjusting lease costs to align with industry expectations, landowners can attract quality tenants and significantly reduce vacancy rates.

The Housing Guild's innovative Online Owner Portal enhances this process by offering mobile-friendly payment solutions and streamlined communication. This allows owners to make informed pricing decisions swiftly. Regular analysis of the industry is crucial, as it enables owners to adjust costs based on local trends and economic signals, ensuring their assets remain appealing in a dynamic leasing environment.

As management specialists emphasize, "A prompt response to feedback can avoid prolonged vacancies," highlighting the importance of responsiveness in pricing strategies. This principle is further supported by the functionalities of the Online Owner Portal.

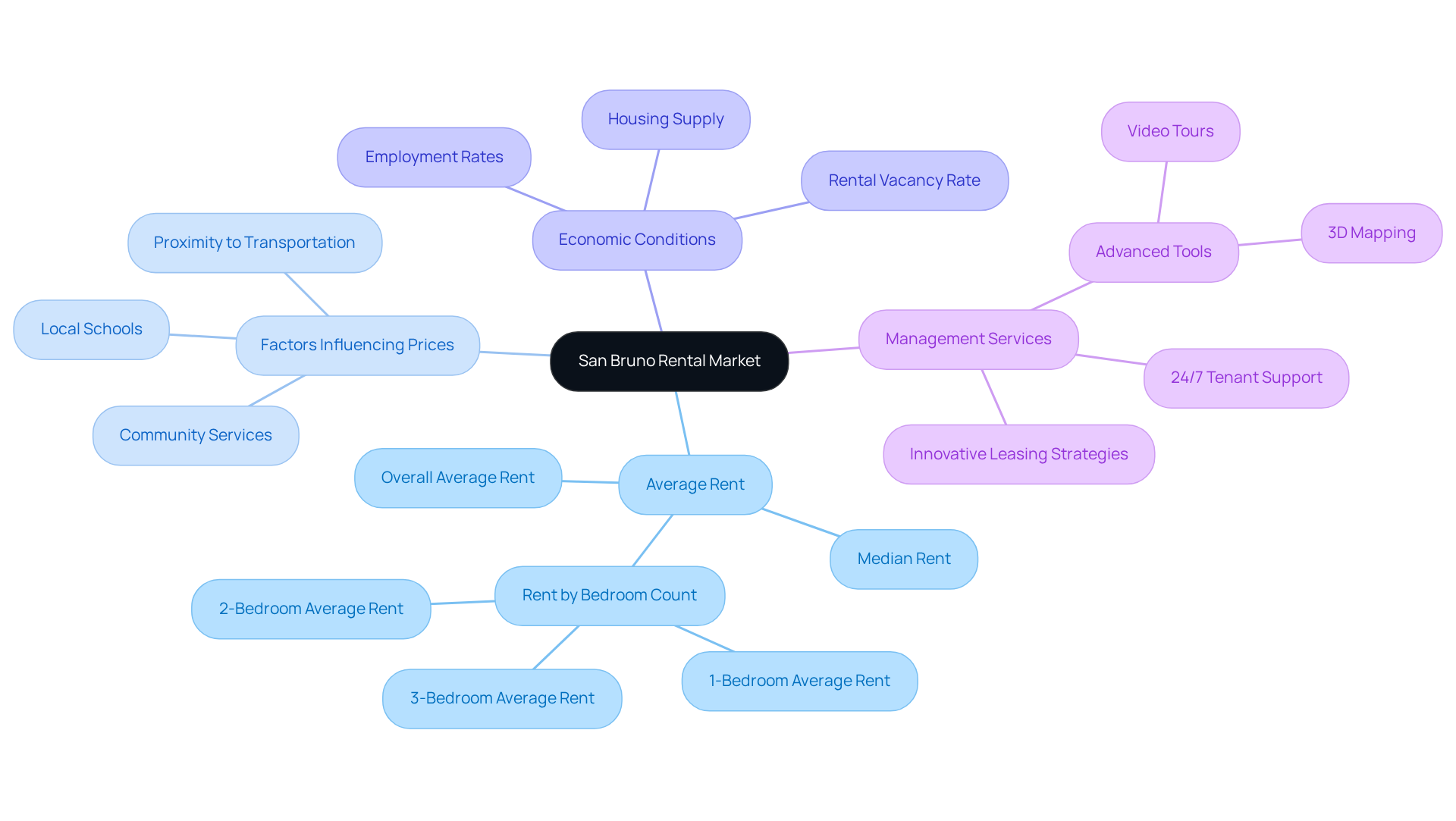

Contextualizing Rent Pricing in the San Bruno Rental Market

The San Bruno leasing market offers a diverse range of residences, from single-family homes to multi-unit apartment buildings. As of November 2025, the average rent in San Bruno is approximately $3,272. This figure reflects a competitive environment where prices vary based on location, property type, and available amenities.

Key factors influencing lease prices include:

- Proximity to public transportation

- Local schools

- Community services

All of which are crucial for attracting tenants. Economic conditions, such as employment rates and housing supply, significantly shape tenant demand and are essential to understanding what is rent pricing strategy in portfolio strategy San Bruno. For example, leasing prices in San Bruno have increased by 5.2% over the past year, indicating strong housing demand. Furthermore, the rental vacancy rate in San Bruno stands at 8.4%, underscoring the competitive nature of the market.

Property owners must remain vigilant regarding what is rent pricing strategy in portfolio strategy San Bruno to effectively adjust their pricing and maintain a competitive edge in the industry. As of November 2025, the median rent for all bedroom counts and types of dwellings in San Bruno, CA, is $3,340, which is 74%, or $1,420, above the national average.

At The Housing Guild, we provide owners with comprehensive management services, including:

- 24/7 tenant support

- Innovative leasing strategies

- Advanced tools like 3D mapping and video tours

This ensures that assets are well-positioned in this dynamic environment.

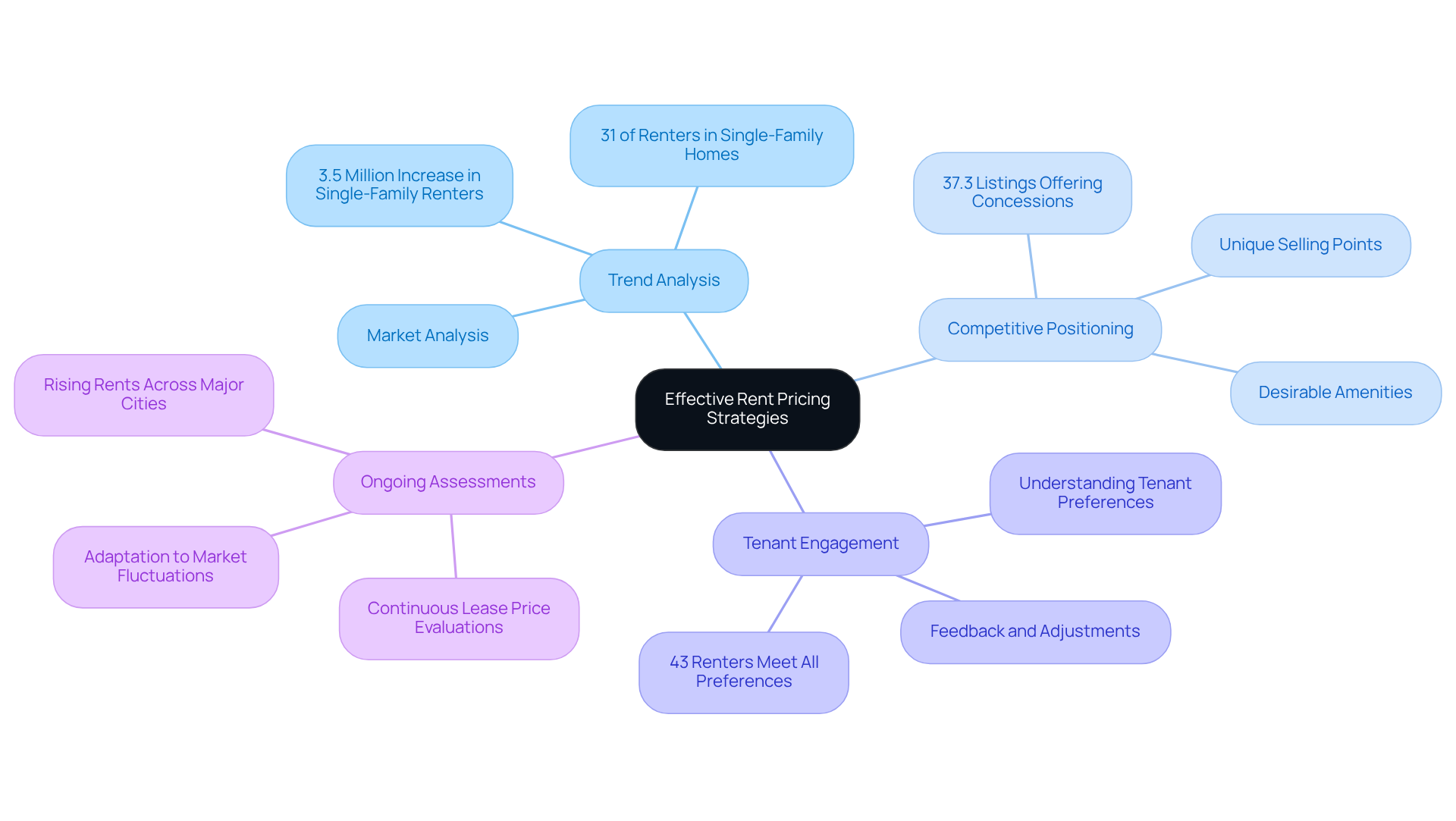

Key Components of Effective Rent Pricing Strategies

What is rent pricing strategy in portfolio strategy San Bruno is critical as effective rental rate strategies hinge on several essential elements: trend analysis, competitive positioning, and tenant engagement.

Trend Analysis

Conducting thorough market analysis involves examining similar assets within the area to establish a competitive rental price. This process not only identifies prevailing rates but also highlights trends that can influence what is rent pricing strategy in portfolio strategy San Bruno. For instance, recent data indicates that 31% of all renters currently reside in single-family homes, reflecting a shift in tenant preferences that property owners should consider. This trend signifies a rise of 3.5 million tenants over the past twenty years, underscoring the growing demand for single-family housing.

Competitive Positioning

Property owners must evaluate their unique selling points, such as desirable amenities and advantageous locations, to justify their pricing. This is particularly crucial in a market where 37.3% of listings are offering concessions, such as discounts or free rent, to attract tenants. As noted by Zillow, "About 37.3% of September rental listings on Zillow offered concessions - discounts like free months of rent." By clearly conveying these benefits, owners can differentiate their offerings in a crowded marketplace.

Tenant Engagement

Tenant involvement is pivotal in shaping cost strategies. Understanding tenant preferences - such as the increasing demand for features like energy-efficient appliances - can guide property owners in making informed pricing adjustments that enhance tenant satisfaction. Regularly seeking feedback and observing tenant needs ensures that lease rates align with expectations. Notably, only 43% of renters lease a unit that meets all three preferences: price, location, and amenities, highlighting the importance of understanding tenant needs.

Ongoing Assessments

Moreover, continuous evaluations of lease prices in response to market fluctuations are essential. As the leasing environment evolves, property owners must adapt to shifts, such as the recent rise in rents across major cities, to remain competitive. By incorporating these elements into their cost strategies, real estate owners can enhance their rental revenue while understanding what is rent pricing strategy in portfolio strategy San Bruno to foster positive tenant relationships.

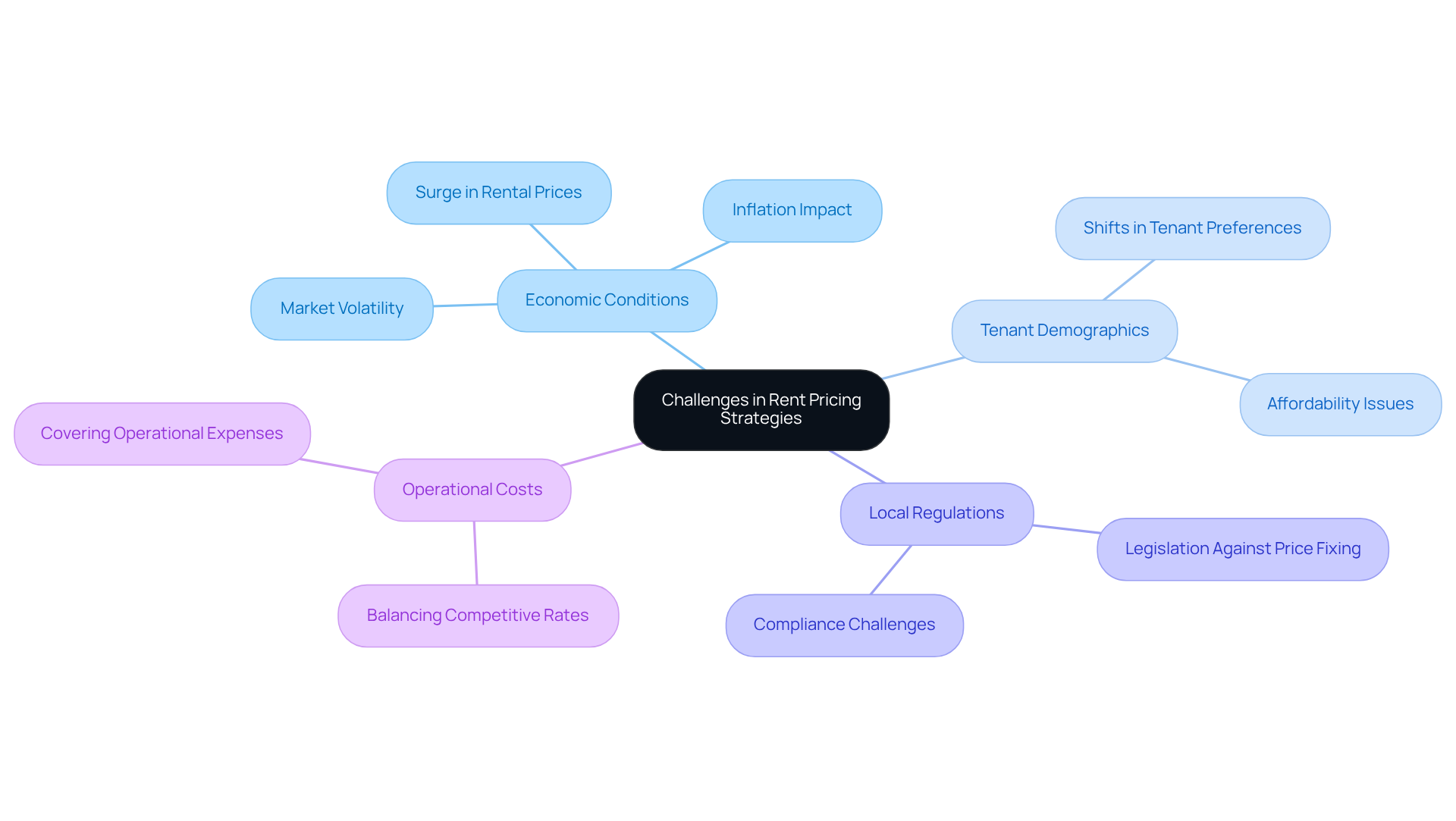

Challenges in Implementing Rent Pricing Strategies for Property Owners

Real estate owners face significant challenges when it comes to understanding what is rent pricing strategy in portfolio strategy San Bruno. A precise evaluation of economic conditions is essential; errors in judgment can lead to either overpricing or underpricing properties. For instance, understanding what is rent pricing strategy in portfolio strategy San Bruno is crucial, as rental prices have surged by 5.2% over the past year, reflecting a volatile market that necessitates continuous monitoring. Furthermore, economic downturns, shifts in tenant demographics, and changes in local regulations complicate decisions regarding costs.

Property owners must strike a delicate balance between competitive rates and covering operational costs, especially in an unpredictable economic landscape. Understanding what is rent pricing strategy in portfolio strategy San Bruno is crucial for developing a flexible pricing strategy that allows for timely adjustments based on market feedback to overcome hurdles and maximize property value.

Conclusion

Understanding the intricacies of rent pricing strategy in San Bruno property management is essential for property owners aiming to optimize their leasing outcomes. A structured approach that considers economic conditions, tenant demographics, and competitive positioning enables owners to set lease prices that maximize revenue and attract quality tenants in a competitive market.

Key components contributing to effective rent pricing strategies include:

- Trend analysis

- Tenant engagement

- Ongoing assessments of market conditions

Adapting to local trends and economic signals is crucial, as is being responsive to tenant needs and preferences. With the rental market in San Bruno showing signs of growth and increased demand, property owners must remain proactive in their pricing strategies to avoid prolonged vacancies and ensure the long-term viability of their investments.

The significance of a well-defined rent pricing strategy cannot be overstated. By leveraging advanced tools and continually assessing market dynamics, property owners can navigate the challenges of the San Bruno rental market with confidence. Embracing these best practices enhances rental revenue and fosters positive tenant relationships, paving the way for sustained success in property management.

Frequently Asked Questions

What is a rent pricing strategy in portfolio management?

A rent pricing strategy in portfolio management is a structured method used by owners and managers to set lease prices for their assets, which involves analyzing factors such as economic conditions, real estate valuation, and tenant demographics.

What is the primary objective of a rent pricing strategy?

The primary objective of a rent pricing strategy is to establish a leasing cost that maximizes revenue while remaining competitive within the industry.

What factors are considered in effective rent pricing strategies?

Effective rent pricing strategies consider operational expenses related to maintenance, the broader economic environment, and tenant demand.

How can adjusting lease costs benefit landowners?

By adjusting lease costs to align with industry expectations, landowners can attract quality tenants and significantly reduce vacancy rates.

What role does the Housing Guild's Online Owner Portal play in rent pricing strategy?

The Housing Guild's Online Owner Portal enhances the rent pricing process by offering mobile-friendly payment solutions and streamlined communication, allowing owners to make informed pricing decisions swiftly.

Why is regular analysis of the industry important for owners?

Regular analysis of the industry is crucial as it enables owners to adjust costs based on local trends and economic signals, ensuring their assets remain appealing in a dynamic leasing environment.

What is the significance of responsiveness in pricing strategies?

Responsiveness in pricing strategies is significant because a prompt response to feedback can help avoid prolonged vacancies, which is emphasized by management specialists.