Introduction

Understanding the dynamics of rent pricing strategy is crucial for property owners aiming to optimize their real estate portfolios. This systematic approach not only assists in setting competitive rental rates but also plays a pivotal role in maximizing revenue and enhancing tenant retention.

However, navigating the complexities of market demands, economic fluctuations, and tenant preferences presents a significant challenge. These elements can greatly influence pricing decisions. How can owners effectively balance these factors to ensure their properties remain attractive while also achieving financial success?

Defining Rent Pricing Strategy in Real Estate Portfolio Management

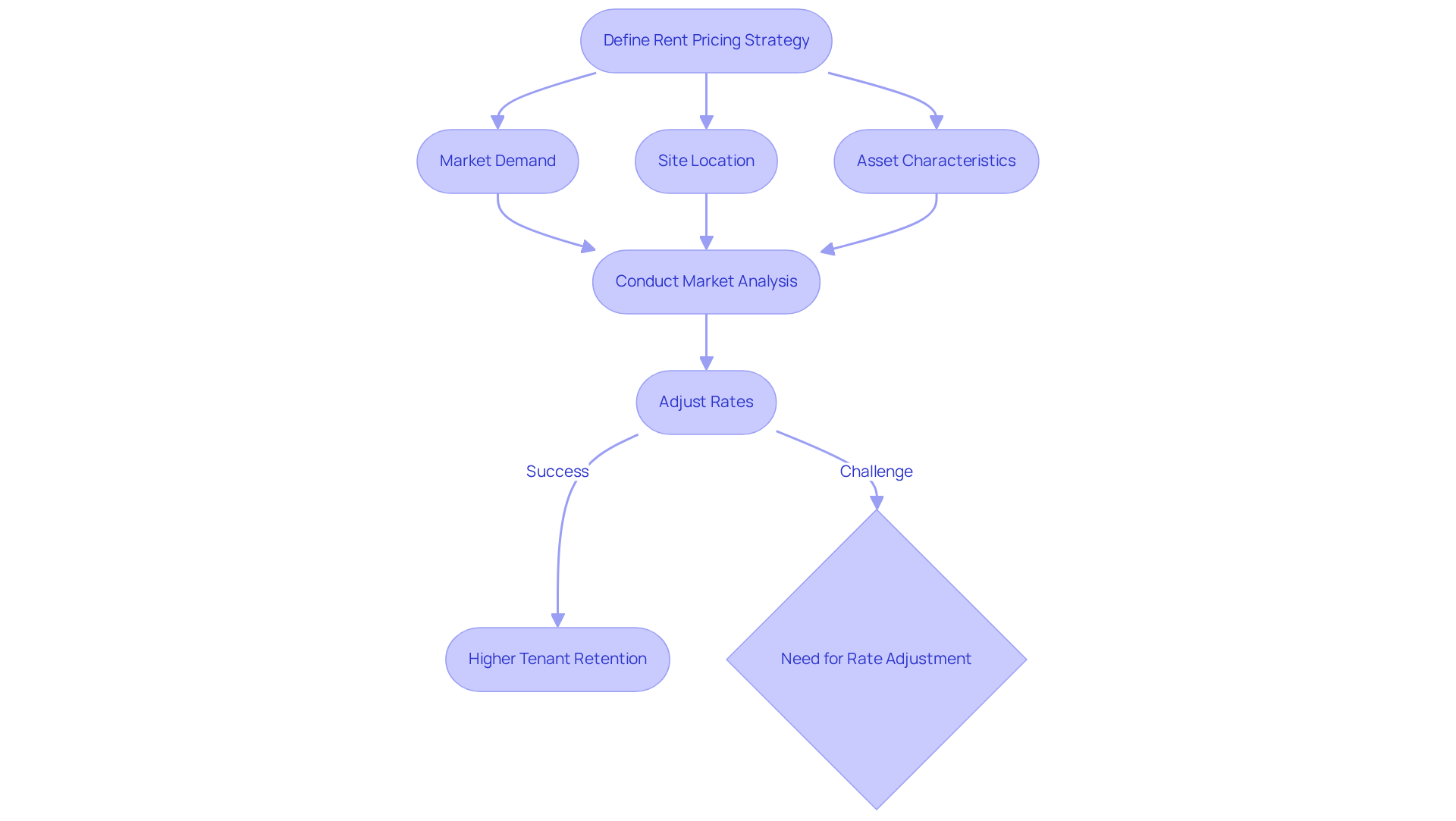

In real estate portfolio management, what is rent pricing strategy in portfolio strategy Belmont represents a systematic approach that property owners employ to establish rental rates for their assets. This methodology is shaped by several critical factors, including market demand, site location, and the unique characteristics of each asset. A well-defined rental charge strategy, or what is rent pricing strategy in portfolio strategy Belmont, not only aims to attract tenants but also focuses on maximizing rental revenue and ensuring long-term tenant retention. Research indicates that properties with competitive pricing and appealing features experience higher tenant retention rates, which is vital for maintaining consistent cash flow.

Moreover, what is rent pricing strategy in portfolio strategy Belmont typically involves ongoing market analysis to adjust rates in response to evolving economic conditions and tenant preferences. To enhance their investment management, real estate owners can utilize The Housing Guild's innovative Online Owner Portal. This mobile-friendly platform facilitates communication and simplifies financial management, enabling owners to make and receive payments with ease. With features such as on-demand access to financial statements and integrated messaging tools, owners can stay connected and informed.

By leveraging real-time financial data from the portal, owners can make informed decisions that directly influence their rent adjustment strategies. By understanding what is rent pricing strategy in portfolio strategy Belmont and implementing effective rent cost techniques, alongside utilizing The Housing Guild's Online Owner Portal, owners can significantly enhance their investment returns and overall portfolio performance.

The Role of Rent Pricing Strategy in Maximizing Property Value

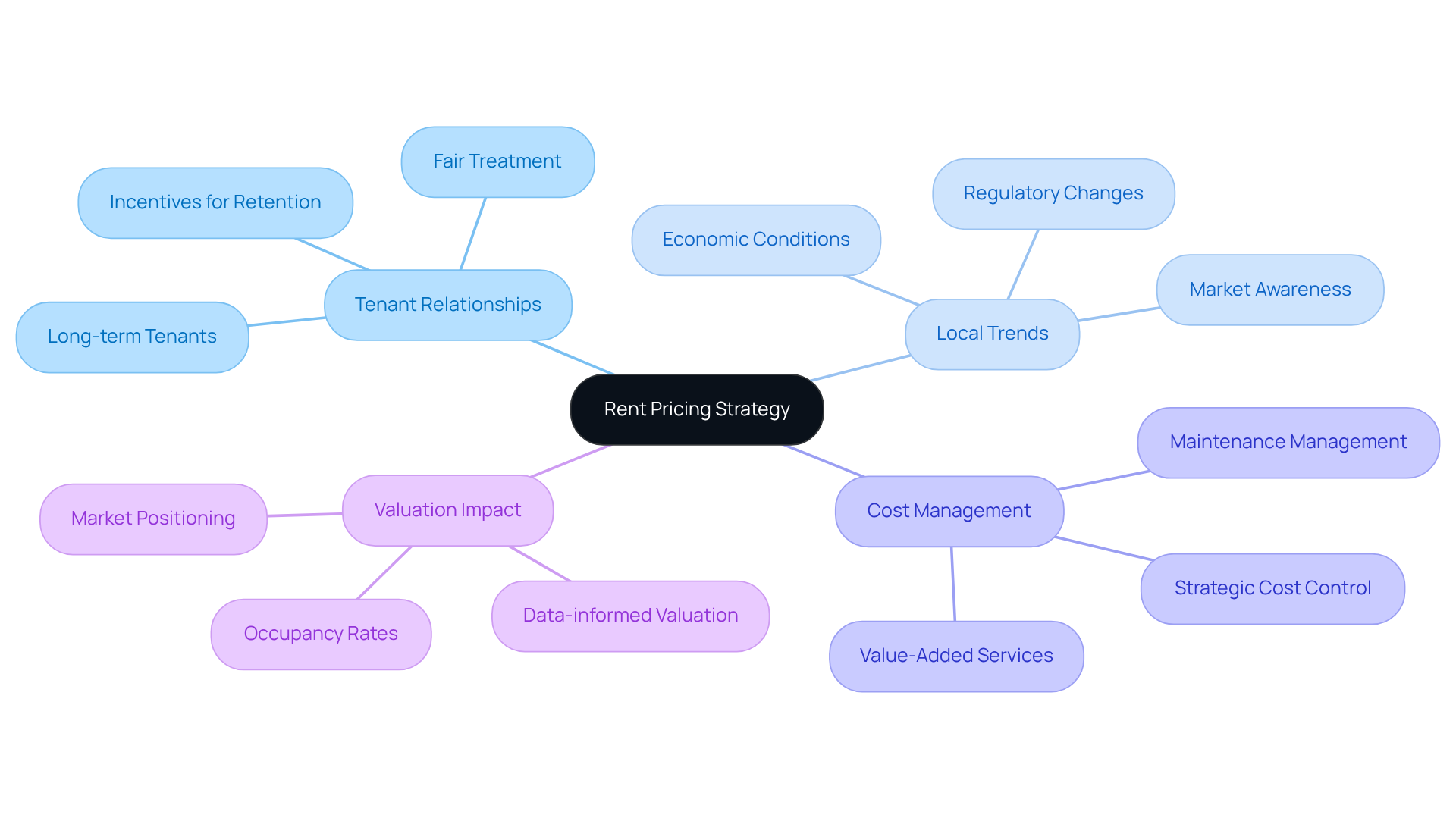

What is rent pricing strategy in portfolio strategy Belmont, and why is it essential for maximizing asset value? By understanding what is rent pricing strategy in portfolio strategy Belmont, owners can set competitive rental rates to attract high-quality tenants who are more likely to stay long-term, significantly lowering turnover costs.

For instance, Larry C., a long-term tenant of The Housing Guild, shared his experience of living in a San Francisco apartment for over 30 years. He appreciated the fair treatment and understanding from his landlords. Notably, his rent was only raised by the legally allowed amount, and any issues within the building were promptly addressed. This type of owner-focused strategy not only encourages tenant loyalty but also aids in maintaining consistent occupancy rates, which generally results in value appreciation over time.

Properties that sustain such positive tenant relationships often experience heightened demand, leading to increased valuation. Furthermore, strategic cost management not only increases occupancy but also improves the overall reputation of the asset, making it more appealing to potential investors and purchasers.

Real estate experts stress that comprehending local trends and tenant preferences is essential for understanding what is rent pricing strategy in portfolio strategy Belmont efficiently. Case studies show that assets utilizing data-informed valuation approaches have effectively enhanced their worth, illustrating the concrete advantages of aligning rental costs with economic conditions.

Moreover, with rents increasing in 46 of the 50 largest metropolitan regions, including San Francisco, real estate owners must remain aware of trends and regulations to modify their cost approaches accordingly. Providing longer lease terms with incentives can also be an effective approach to lower turnover costs and improve tenant retention.

Key Components of an Effective Rent Pricing Strategy

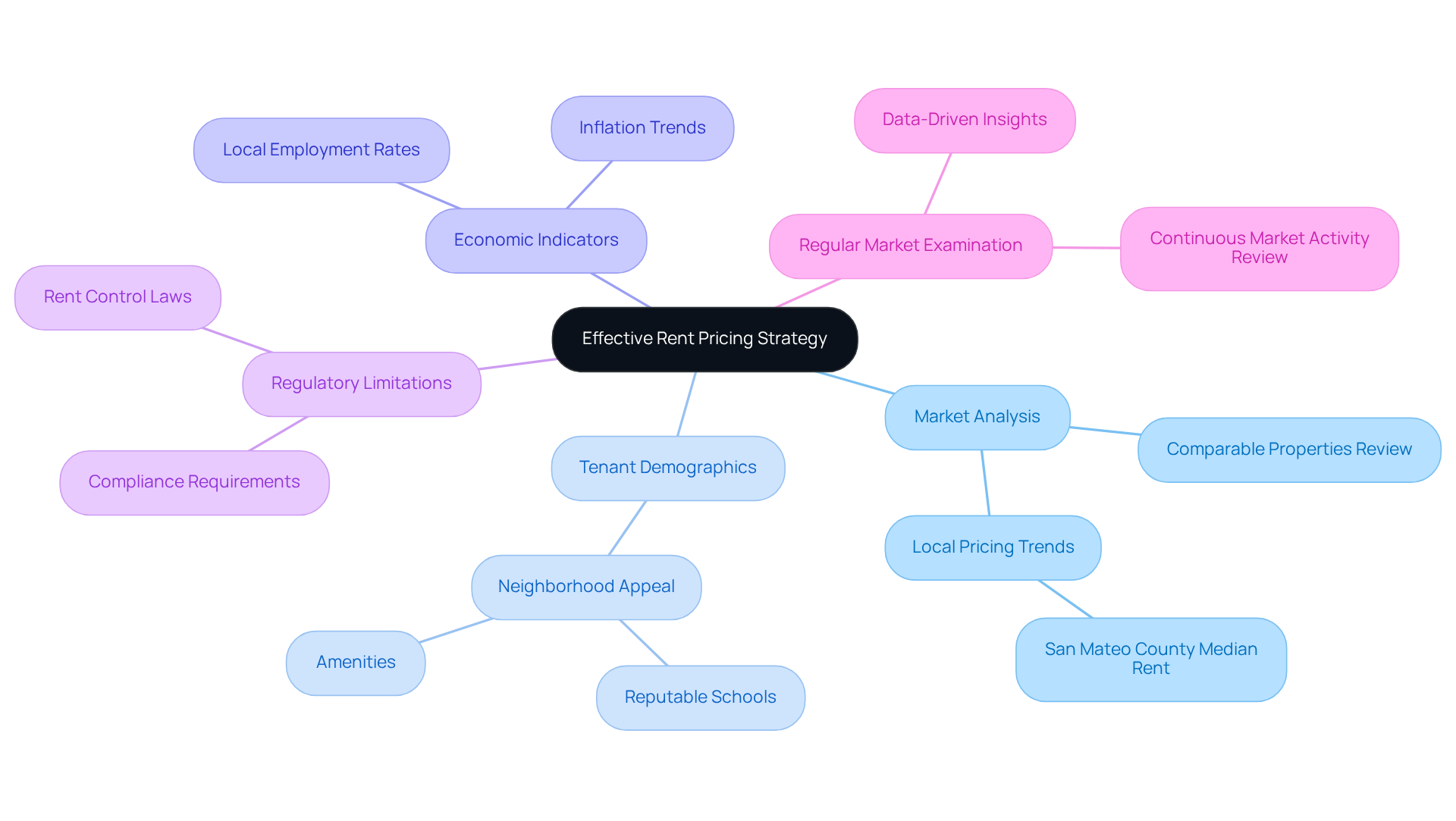

What is rent pricing strategy in portfolio strategy Belmont, and how does it hinge on several essential elements such as market analysis, tenant demographics, building features, and economic indicators?

Market Analysis

Market analysis entails a thorough review of comparable properties in the area to ascertain competitive rates. This process typically involves identifying at least three rental comps that align in size, type, condition, and amenities, ensuring accuracy in pricing decisions. For instance, in 2021, San Mateo County recorded the highest median rent in the Bay Area at over $2,400 per month, underscoring the importance of grasping local pricing trends.

Tenant Demographics

Understanding tenant demographics is equally vital, as it enables owners to tailor their offerings to meet the preferences and needs of potential renters. Neighborhoods with reputable schools and amenities tend to attract more renters and can command higher rental rates.

Economic Indicators

Economic indicators, such as local employment rates and inflation trends, also significantly influence rental prices. Areas experiencing economic growth often witness increased rental demand due to higher wages and job opportunities.

Regulatory Limitations

Additionally, regulatory limitations, such as rent control laws, can greatly impact rental cost strategies, potentially restricting the ability to raise rents in favorable conditions. By integrating these elements, landowners can develop a flexible pricing approach that adapts to evolving economic circumstances.

Regular Market Examination

Regular examination of local market activity is crucial for establishing effective rental rates, enabling landlords to remain competitive and optimize rental income. As Lucy Pham notes, "The Rental Market Analysis (RMA) serves as a guide for landlords to enhance their rental properties," emphasizing the importance of leveraging data-driven insights to inform pricing decisions.

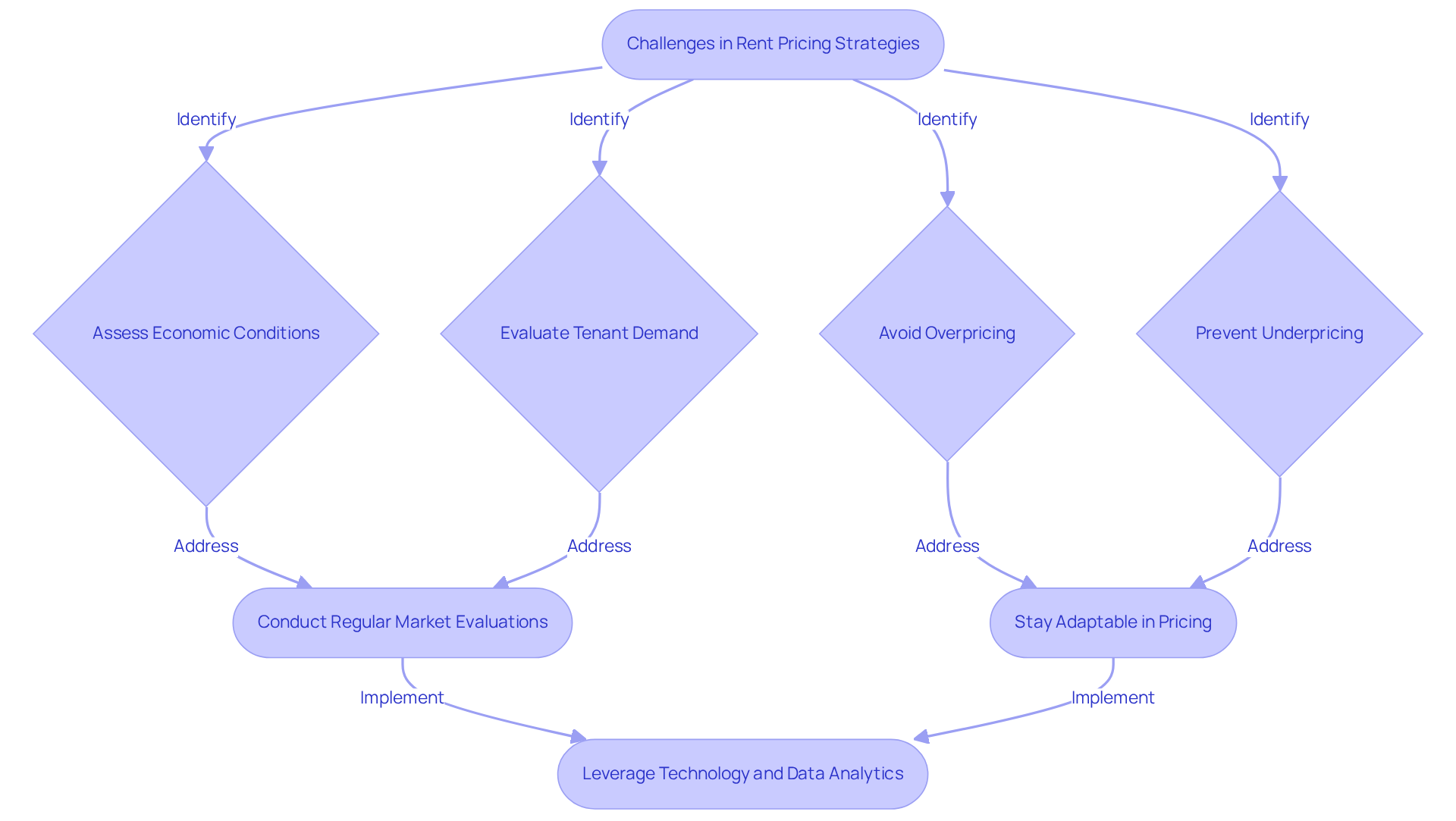

Challenges in Implementing Rent Pricing Strategies

Property owners face several challenges when implementing what is rent pricing strategy in portfolio strategy Belmont. One significant issue is the difficulty in accurately assessing economic conditions and tenant demand, which raises questions about what is rent pricing strategy in portfolio strategy Belmont. Overpricing can lead to prolonged vacancies, while underpricing may result in lost revenue. Additionally, external factors such as economic downturns or changes in local regulations can significantly impact rental costs.

To address these challenges, property owners should conduct regular evaluations of the market, specifically focusing on what is rent pricing strategy in portfolio strategy Belmont. Staying adaptable in pricing strategies is crucial. Furthermore, leveraging technology and data analytics can facilitate informed pricing decisions that align with current market trends.

Conclusion

Understanding the complexities of rent pricing strategy in portfolio management is crucial for property owners seeking to optimize their investments. This strategy not only helps establish competitive rental rates but also improves tenant retention and maximizes revenue. By implementing a structured pricing strategy, owners can keep their properties appealing in a fluctuating market, ultimately leading to sustained financial success.

Key insights discussed throughout the article include:

- The importance of continuous market analysis

- Understanding tenant demographics

- Adapting to economic indicators

The role of technology, particularly platforms like The Housing Guild's Online Owner Portal, serves as a valuable resource for property owners to make informed decisions. Additionally, maintaining positive tenant relationships and recognizing the impact of regulatory factors on rental pricing are essential elements in developing an effective strategy.

In the dynamic landscape of real estate, adapting rent pricing strategies in response to market dynamics is vital. Property owners are encouraged to leverage data-driven insights and stay alert to local trends to enhance their portfolio management. By prioritizing a comprehensive approach to rent pricing, owners can improve their property values and create a more stable and rewarding investment environment for themselves and their tenants.

Frequently Asked Questions

What is a rent pricing strategy in real estate portfolio management?

A rent pricing strategy in real estate portfolio management is a systematic approach employed by property owners to establish rental rates for their assets, influenced by factors such as market demand, site location, and the unique characteristics of each property.

What are the goals of a well-defined rental charge strategy?

The goals of a well-defined rental charge strategy include attracting tenants, maximizing rental revenue, and ensuring long-term tenant retention.

How does competitive pricing affect tenant retention?

Research indicates that properties with competitive pricing and appealing features experience higher tenant retention rates, which is essential for maintaining consistent cash flow.

What role does ongoing market analysis play in rent pricing strategy?

Ongoing market analysis is crucial in rent pricing strategy as it allows property owners to adjust rates in response to evolving economic conditions and tenant preferences.

How can real estate owners enhance their investment management?

Real estate owners can enhance their investment management by utilizing The Housing Guild's innovative Online Owner Portal, which facilitates communication and simplifies financial management.

What features does The Housing Guild's Online Owner Portal offer?

The Online Owner Portal offers features such as on-demand access to financial statements, integrated messaging tools, and the ability to make and receive payments easily.

How does real-time financial data influence rent adjustment strategies?

Real-time financial data from the portal enables owners to make informed decisions that directly influence their rent adjustment strategies, ultimately enhancing investment returns and overall portfolio performance.