Introduction

Understanding the complexities of rent pricing strategies is crucial for property managers in Daly City. The competitive rental market necessitates a thorough awareness of various influencing factors. This article explores a systematic approach that landlords can adopt to optimize rental fees, striking a balance between profitability and tenant affordability. Given the fluctuating market conditions and evolving tenant expectations, property managers must effectively navigate the intricacies of rent pricing to ensure their portfolios thrive.

Defining Rent Pricing Strategy in Property Management

What is rent pricing strategy in portfolio strategy Daly City is a systematic approach that landlords and managers utilize to determine rental fees for their assets. This strategy considers several essential factors, including market demand, location, available amenities, and prevailing economic conditions. A well-designed rental fee strategy is essential for understanding what is rent pricing strategy in portfolio strategy Daly City, aiming to balance profitability for owners with affordability for renters, ensuring assets remain competitive in the leasing market.

Key elements of a successful leasing cost strategy involve:

- Examining comparable rental properties to assess market rates.

- Understanding resident demographics to tailor offerings.

- Adjusting prices in response to seasonal trends and economic fluctuations.

For instance, as of March 2025, the U.S. median housing cost has been decreasing for 20 consecutive months, prompting landlords to reassess their pricing strategies to attract tenants in a competitive environment.

Effective leasing cost strategies often include proactive measures, such as:

- Incorporating desirable features.

- Focusing on high-demand areas.

Properties that offer smart home technology and eco-friendly features are increasingly appealing to younger renters, who prioritize modern conveniences. Additionally, landlords should remain adaptable to local regulations, such as California's cap on annual rental increases, which can influence pricing flexibility.

In 2025, understanding what is rent pricing strategy in portfolio strategy Daly City is essential for optimizing rental income while minimizing vacancy rates. By staying informed about current trends and regional variations, managers can effectively navigate the evolving rental landscape and enhance their overall profitability.

The Role of Rent Pricing in Portfolio Strategy for Daly City

In Daly City, understanding what is rent pricing strategy in portfolio strategy is crucial for managing rental costs, significantly impacting occupancy rates and overall profitability. The competitive landscape of the San Francisco Bay Area necessitates that managers adopt dynamic pricing strategies that respond to current market conditions.

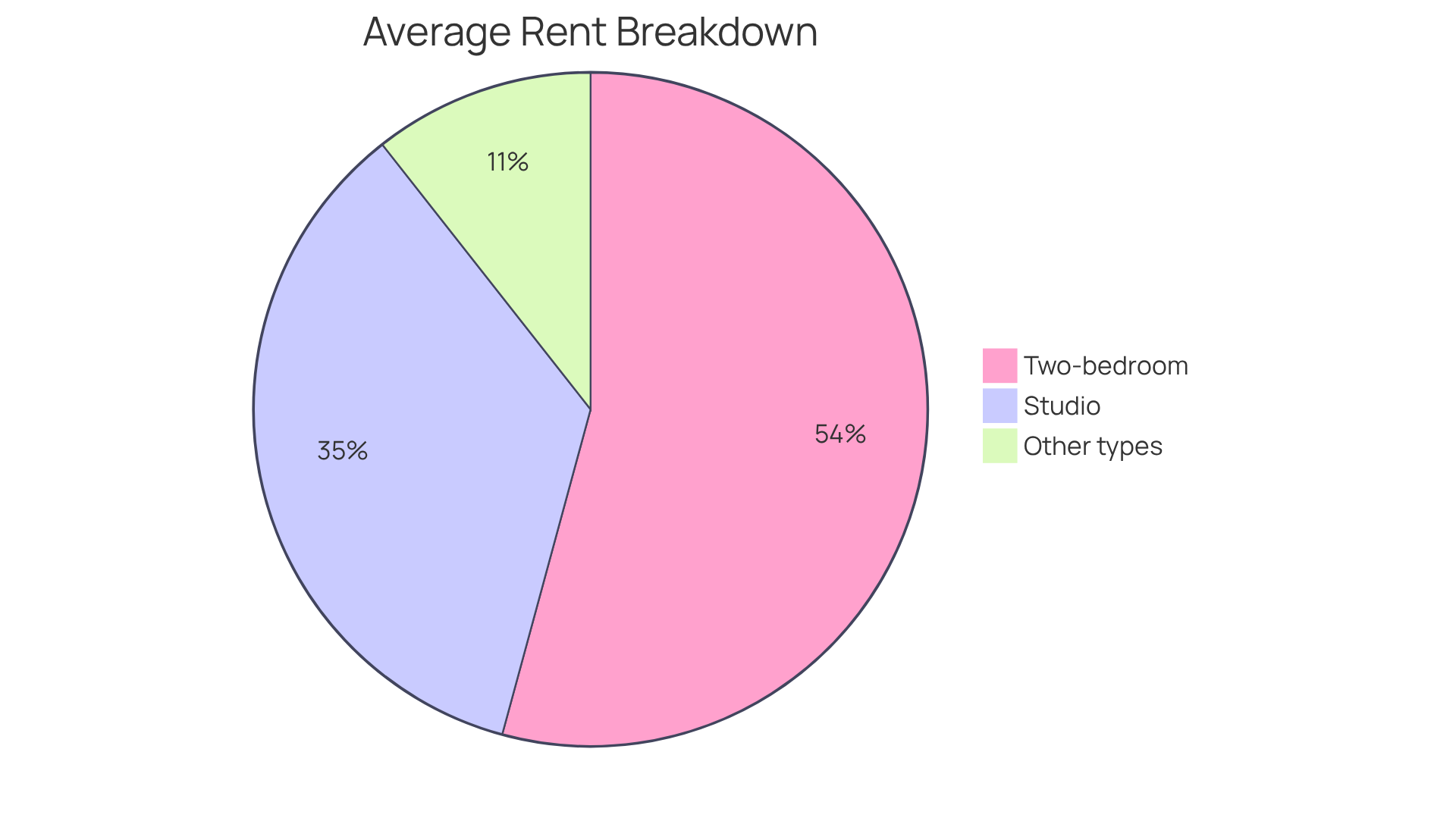

As of November 2025, the average rent in Daly City hovers around $2,600, with variations depending on the type of residence and its location. For instance:

- Two-bedroom apartments average approximately $3,068

- Studio apartments are priced at about $1,990

Managers can effectively attract and retain occupants by consistently analyzing market trends and adjusting rental rates according to what is rent pricing strategy in portfolio strategy Daly City, thereby optimizing their portfolio's financial performance. Furthermore, a deep understanding of local demographics and economic factors enables more strategic cost decisions that align with renter expectations and market demand.

This proactive approach not only enhances occupancy rates but also contributes to the long-term success of management in the region.

Key Components of Effective Rent Pricing Strategies

Successful rental fee strategies require understanding what is rent pricing strategy in portfolio strategy Daly City, along with several essential elements:

- Comprehensive market analysis

- Understanding tenant demographics

- Assessing building characteristics

- Tracking economic indicators

Market analysis is vital for determining competitive pricing by examining similar assets within the area, particularly in understanding what is rent pricing strategy in portfolio strategy Daly City. This process enables real estate managers to establish what is rent pricing strategy in portfolio strategy Daly City, which reflects current market conditions. For instance, in 2025, the Southwest region is projected to experience the highest increase in rental prices at 3.4%, while national growth in rental costs is expected to be around 3%. This broader context underscores the necessity for localized analysis to leverage regional trends.

Understanding resident demographics is equally important, as it allows property managers to tailor what is rent pricing strategy in portfolio strategy Daly City to attract the right audience. Younger tenants, particularly Millennials and Gen Z, prioritize flexibility and digital connectivity. Notably, 90% of Gen Z and 87% of Millennials anticipate online payment options. The Housing Guild's online portal meets this expectation by enabling tenants to securely pay their housing fees online, set up automatic payments, submit maintenance requests, communicate with management, and easily provide proof of insurance coverage or purchase a policy. This illustrates the significance of these features in influencing their willingness to pay for specific amenities.

Property characteristics, including location and available amenities, significantly impact rental costs. Properties equipped with smart home features or energy-efficient upgrades can command higher rents, as renters are increasingly willing to pay premiums for these enhancements.

Economic indicators, such as local employment rates and inflation, also play a crucial role in determining what is rent pricing strategy in portfolio strategy Daly City, as they influence rental demand and cost strategies. With current occupant retention rates around 60%, maintaining competitive rates is essential for minimizing turnover and maximizing rental revenue. As Howard Smith noted, incorporating insights into real estate management strategies can enhance resident satisfaction and retention. By integrating these elements into a flexible valuation model, managers can adapt to fluctuating market conditions and efficiently enhance their rental revenue.

Challenges in Implementing Rent Pricing Strategies in Daly City

Understanding what is rent pricing strategy in portfolio strategy Daly City involves navigating a landscape characterized by fluctuating market conditions, regulatory constraints, and tenant expectations. Recent data indicates that average rental costs have risen by 3.87% over the past year, highlighting the necessity for managers to remain adaptable and responsive to these shifts.

Local rent control regulations add complexity to cost decisions, as compliance must be balanced with the goal of maintaining profitability. Additionally, resident expectations significantly influence rental dynamics; if prices are perceived as excessive relative to building conditions or amenities, vacancy rates may rise.

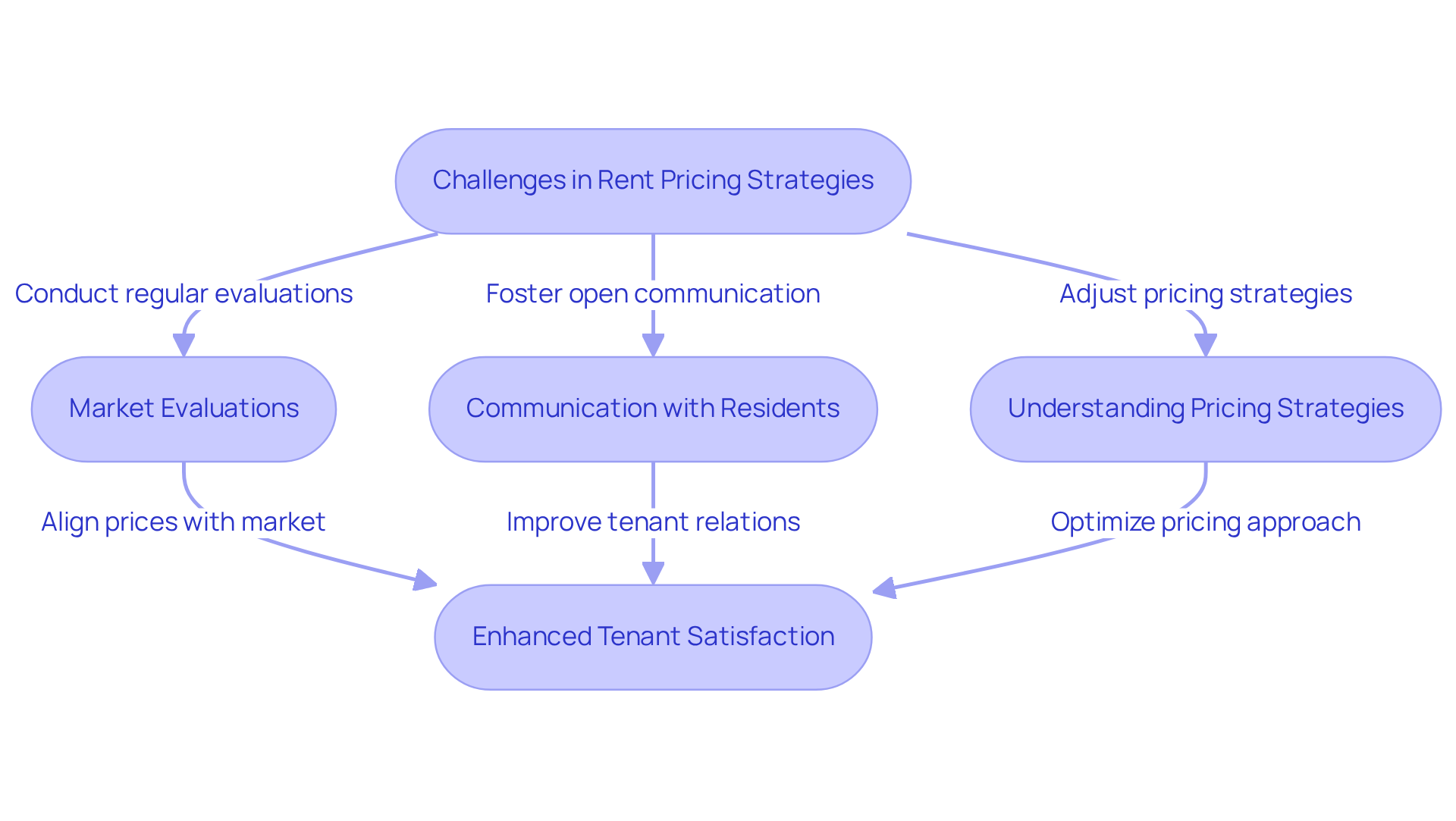

To effectively address these challenges, property managers should:

- Engage in regular market evaluations

- Foster open communication with residents

- Understand what is rent pricing strategy in portfolio strategy Daly City to adjust pricing strategies as necessary

This proactive approach not only aligns rental prices with market realities but also enhances tenant satisfaction, ultimately contributing to a more stable rental environment.

Conclusion

Understanding rent pricing strategy in portfolio management is crucial for landlords and property managers who aim to optimize their rental income while ensuring affordability for tenants. This systematic approach balances profitability with the competitive dynamics of the rental market, particularly in areas like Daly City. By carefully evaluating market conditions, tenant demographics, and property features, managers can develop effective pricing strategies that attract and retain occupants.

Key components of successful rent pricing strategies include:

- Comprehensive market analysis

- An understanding of tenant needs

- Adaptability to economic changes

Incorporating desirable amenities and being aware of local regulations further emphasizes the need for a proactive approach in managing rental costs. Additionally, recognizing the challenges posed by fluctuating market conditions and resident expectations is vital for maintaining occupancy rates and minimizing turnover.

The significance of a well-defined rent pricing strategy cannot be overstated. By staying informed about current trends and regional variations, property managers can navigate the complexities of the rental landscape more effectively. Embracing these strategies enhances financial performance and fosters a positive living environment, encouraging tenant satisfaction and loyalty. For those involved in property management, investing time and resources into developing a robust rent pricing strategy is essential for long-term success in Daly City and beyond.

Frequently Asked Questions

What is a rent pricing strategy in property management?

A rent pricing strategy is a systematic approach used by landlords and property managers to determine rental fees for their assets, considering factors such as market demand, location, available amenities, and economic conditions.

Why is a well-designed rental fee strategy important?

A well-designed rental fee strategy is crucial for balancing profitability for property owners with affordability for renters, ensuring that assets remain competitive in the leasing market.

What are the key elements of a successful leasing cost strategy?

Key elements include examining comparable rental properties to assess market rates, understanding resident demographics to tailor offerings, and adjusting prices in response to seasonal trends and economic fluctuations.

How has the U.S. housing market influenced rent pricing strategies?

As of March 2025, the U.S. median housing cost has been decreasing for 20 consecutive months, prompting landlords to reassess their pricing strategies to attract tenants in a competitive environment.

What proactive measures can landlords take in their leasing cost strategies?

Proactive measures include incorporating desirable features, focusing on high-demand areas, and adapting to local regulations that influence pricing flexibility.

What features are increasingly appealing to younger renters?

Features such as smart home technology and eco-friendly amenities are increasingly appealing to younger renters who prioritize modern conveniences.

How do local regulations impact rent pricing strategies in California?

Local regulations, such as California's cap on annual rental increases, can influence landlords' pricing flexibility and the overall rent pricing strategy.

Why is it essential for property managers to stay informed about current trends and regional variations?

Staying informed about current trends and regional variations is essential for optimizing rental income while minimizing vacancy rates, helping managers effectively navigate the evolving rental landscape.